2021 electric car tax credit california

Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. This California EV rebate typically awards between 1000 and 3500 for plug-in hybrids.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Ford Mustang Mach-E Premium Select and GT EV.

. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. We have some great news. 2021 Electric Vehicles Tax Credits.

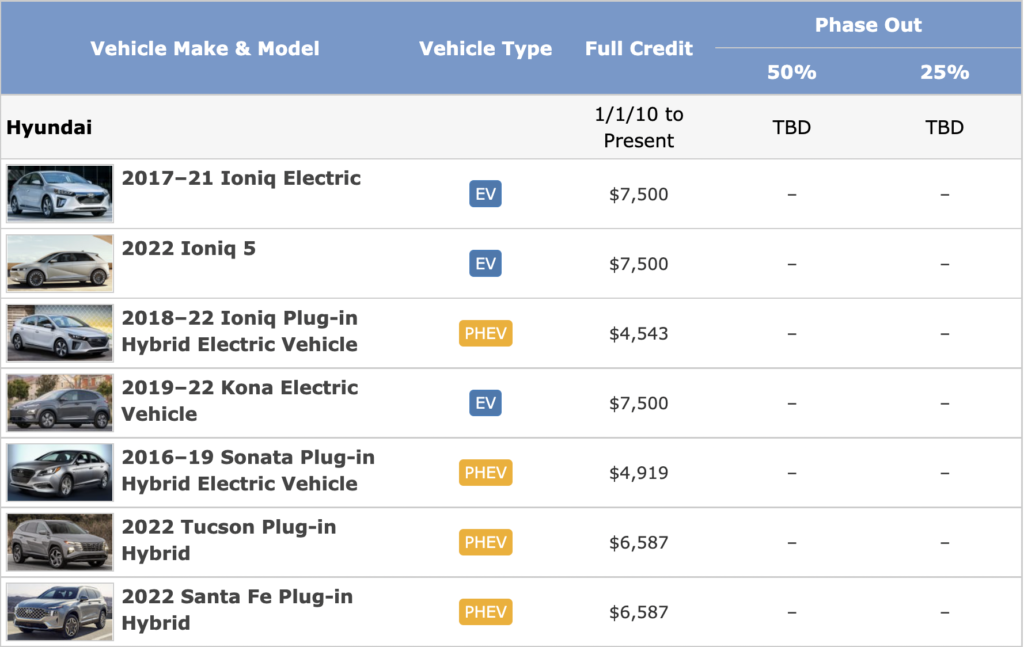

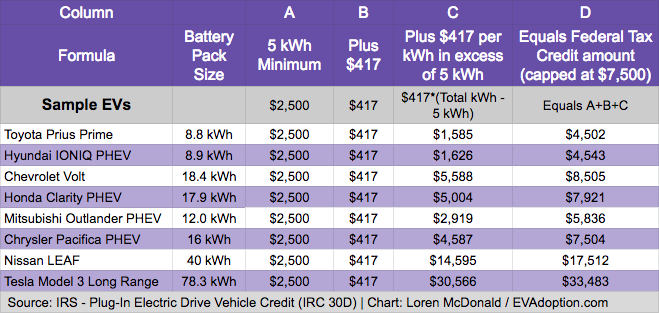

Fueling equipment for natural gas propane liquefied hydrogen electricity E85 or diesel fuel blends containing a minimum of 20 biodiesel installed through December 31 2021 is eligible for a tax credit of 30 of the cost not to exceed 30000. March 27 2022 March 29 2022 Technology by Adam Green. For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity.

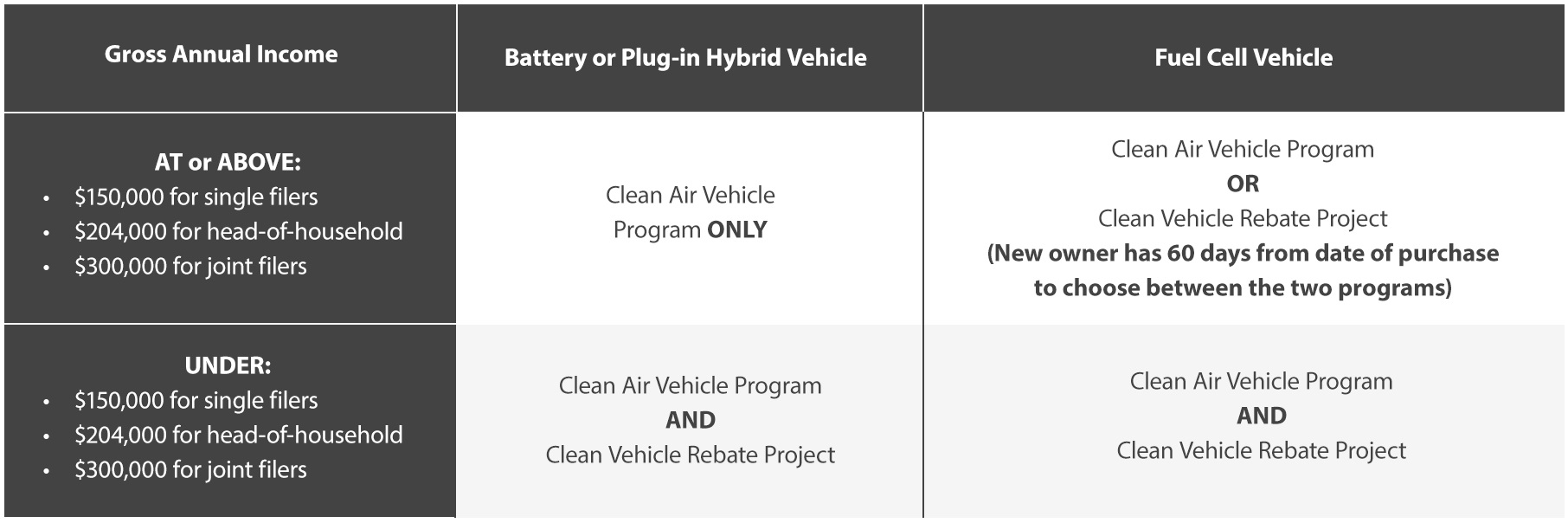

Plug-in hybrids get 1000 battery-electric cars can get a 2000 rebate and hydrogen fuel-cell cars are eligible for 4500. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. For example if you can claim a 7500 tax credit but the amount you owe is only 5000 you will only be able to use 5000 of the available tax credit.

As of August 2021 the US Senate through a non-binding solution has approved a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit. Are there federal tax credits for new all-electric and plug-in hybrid vehiclesThis link will provide you an update by car manufacturer. Unlike the federal tax credit the California rebate comes in the form.

If you purchase or lease a Jeep Plug-in Hybrid Electric Vehicle PHEV you might be eligible for up to a 7500 federal tax credit. 2000 to 4500 for battery electric vehicles. Keep in mind that not all online or software-based tax systems support this form.

Grand Cherokee 4xe coming winter 2022. California electric car tax credit 2021. Plug-in hybrids tend to qualify for tax credits corresponding to their reduced all-electric range.

So how much is the federal tax credit worth. Clean Vehicle Rebate Program CVRP Get up to 7000 to purchase or lease a new plug-in hybrid electric vehicle PHEV battery electric vehicle BEV or a fuel cell electric vehicle FCEV. CVRP offers vehicle rebates on a first-come first-served basis and helps get the cleanest vehicles on the road in California by providing consumer rebates to reduce the initial cost of advanced.

The exact amount varies depending on the vehicles battery capacity but electric vehicles have historically qualified for the full amount. Inspiring and educating bright minds from around the world. Qualified Plug-In Electric Drive Motor Vehicles IRC 30D Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks.

SUBJECT Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40 percent credit for costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle. 5 Symptoms of a Bad Front and Rear Wheel Bearings. A qualified taxpayer would be allowed a maximum credit for installations during the taxable year of.

Bill Analysis Bill Number. And 4500 to 7000 for fuel cell electric vehicles. Permitting and inspection fees are not included in covered expenses.

Funds for this program may become exhausted before the fiscal year ends but applicants will be placed on a rebate waiting list in this case. That amount is the cutoff point. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

Why Your Next Car Should Be Electric. Ford Mustang Mach-E First Edition Premium California Route 1 Premium Select and GT EV. And April 7 2021.

500 per Level 2 vehicle supply equipment and 2500 per direct current fast charger. The state of California has their own cash rebate program for its residents who. Credit for Buying a Hybrid.

As of 2021 California Florida Texas and Washington account for more than half of all the EVs currently driven in the United States. The maximum amount that their tax credit can be is 5000. State-based EV charger tax credits and incentive programs vary widely from state to state.

Does the EV Tax Credit Apply to Used Cars. BMW Electric Vehicle Tax Credit Information for 2021 If youve begun to consider making the switch to a plug-in hybrid or an all-electric vehicle youre probably familiar with their compelling list of benefits including outstanding savings on fuel exhilarating power delivery and serene driving characteristics. Eligible vehicles such as EVs can qualify for up to 7500.

Electric cars EVs are dominating the market right now. With possible additional state incentives. With most car manufacturers stepping up the gears to design the next.

2022 Electric Vehicles Tax Credits. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market. If you purchased a new EV in May of 2021 you would apply for the tax credit when you file your 2021 taxes at the beginning of 2022.

You cannot claim a tax refund through the electric vehicle tax credit. Now thats a bang for your buck. You must fill out IRS Form 8936 when filing your annual income tax returns.

The credit amount will vary based on the capacity of the battery used to power the vehicle. Ford Escape Plug-In Hybrid. The amount of tax credit you can claim depends on how much you owe in taxes as this is a non-refundable tax credit.

But if someone owes more than 7500 in taxes then they cannot claim a higher tax credit than 7500. Here well outline some the state-based EV charger tax credit and incentive programs in each of these states as of this writing.

2021 Jeep 4xe Hybrid Tax Credits Incentives By State

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Income Eligibility Clean Vehicle Rebate Project

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Top States For Electric Vehicles Quotewizard

California Ev Incentive Is Getting Smaller In November

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

How Do Electric Car Tax Credits Work Credit Karma

Electric Vehicle Tax Credits What You Need To Know Edmunds

Southern California Edison Incentives

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

The Continued Transition To Electric Vehicles In U S Cities International Council On Clean Transportation

Ev Incentives Ev Savings Calculator Pg E

Electric Vehicle Stocks Tumble After Manchin Rejects Biden S Climate And Social Plan

Electric Vehicle Purchase Guidance Program Monterey Bay Electric Vehicle Alliance

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption